Bitcoin Price Report for December 30, 2016

Dec 30, 2016 --- (ARCHIVED) Free Reports

Market Commentary:

Rationality is finally returning to the market following a rather manic period of buying over the course of the past week. After failing to break back above the 970 $ level yesterday, sellers began to move into the market to drive prices down in classic bull market fashion before finding a bottom at near term support where buyers reemerged. Now that price is back around the 950 $ level on relatively mixed technicals conditions going into yet another long holiday weekend, we still think that caution is warranted for the time being despite our VST ProTrade long entry trigger at [members-only text] overnight. We will remain in this position for the next handful of days if need be, but will also be working with a stop closer to [members-only text] considering we have already seen a decent move off of the local lows.

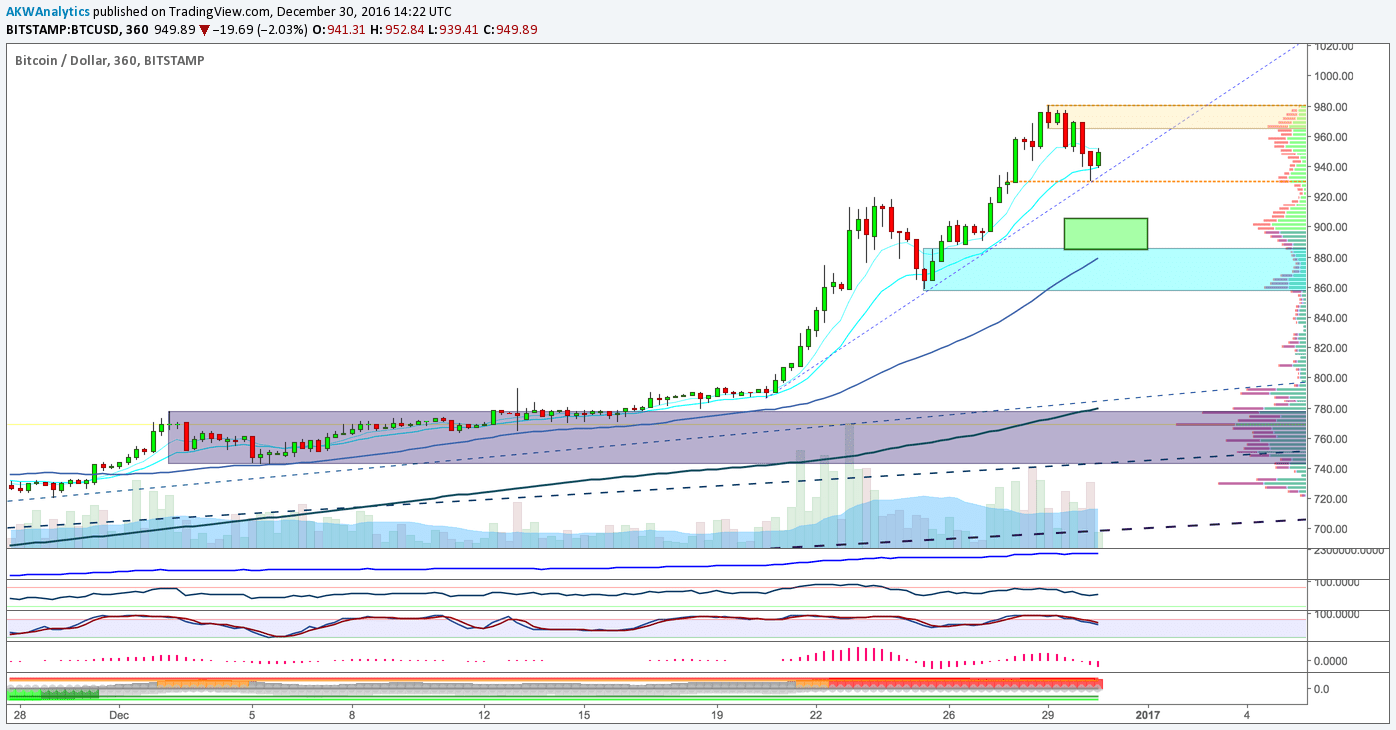

Today we take another look at the 6-hour chart due to the fact that we think it gives is the best view of the short to medium term technical picture. We can see that price currently seems to be mimicking the pullback from last week which was precipitated by a bearish pivot on overbought and divergent momentum, and was also stopped by trendline and historical support. Also note that despite the recent [members-only text] and somewhat [members-only text] market structure, SCMR has not painted any [members-only text] candles yet and in fact is already trying to shift back to [members-only text]. Additionally, dynamic support continues to build around the key [members-only text] level while the near term uptrend line and an area of resistance turned support both provide a good spot to shoot against for new scalp longs.

Moving on to momentum and volume and it becomes clear that we have not yet had a [members-only text], however the selloff so far as been a good start. Notice that Willy and the Stochastic are just now coming down out of officially overbought territory while RSI continues to try to work off its bearish divergence, plus MACD has crossed back below its zeroline and PPO continues to flash strong sell signals. Conversely, the EMA's remain bullish, the SMA's are supportive and still confirming [members-only text], the A/D line continues to trend higher, and exchange volumes have not yet sent a clear sell signal.

While we cannot rule out the possibility of a continuation to the downside prior to a resumption of the push to new highs, we think it will present an even more attractive long entry opportunity in the critical [members-only text] area. We would be unequivocal buyers of such a move, even though it would mean [members-only text], due to the fact that risk/reward would be quite attractive down at those levels. On the other hand, there is also a decent chance that what we saw overnight was it in terms of the pullback and we simply tread water until the indicators are recharged early next week. Either way, we feel prepared for what the market might throw at us this weekend, the final one of 2016.

Posted ProTrade Ideas:

1a.) **Bitcoin ProTrade - Very Short Term [UPDATED on 12/30/2016]**: We will consider a [members-only text] position in the [members-only text] area with a stop around [members-only text] and a target of [members-only text].

1b.) **Bitcoin ProTrade - Very Short Term [ACTIVE; ENTERED on 12/30/2016]**: We will stay [members-only text] off of the [members-only text] level with a stop around [members-only text] and a target of [members-only text].

2.) **Bitcoin ProTrade - Short Term [UPDATED on 12/30/2016]**: We will consider a [members-only text] position in the [members-only text] area with a stop around [members-only text] and a target of [members-only text].

3.) **Bitcoin ProTrade - Medium Term [UPDATED on 12/30/2016]**: We will consider a [members-only text] on a move to the [members-only text] area with a stop around [members-only text] and a target of [members-only text].

4.) **Bitcoin ProTrade - Long Term [ACTIVE; UPDATED on 12/28/2016]**: We will stay [members-only text] off of the [members-only text] level with a stop around [members-only text] and a target of [members-only text]. We will add to the position in the [members-only text] area.

**Premium members get to see live trades complete forecasts, and full charts everyday.

To get your access to our edge, subscribe today.**